If you are the one who is relocating or travelling or planning to stay away from home for a work-related purpose, the Australian Taxation Office (ATO) offers you an allowance – “Living Away from Home Allowance.” With this approved allowance from ATO, an individual gets relief in the taxable income when living away from home with assistance in accommodation, food or drink, and other living costs. LAFHA intends to provide enough compensation to individuals who work away from homes. The compensation includes accommodation, food, travel, and insurance-related expenses. The payment can be made in two parts/components – one is the Accommodation Component & the other is Food Component. However, there can be inclusion or exclusion of some extra costs or expenses like utilities, and others.

To be eligible for LAFHA, individuals must complete their employment responsibilities. Also, they must be living away from their primary residence with the continuation of its use at any period of time while working on their timely work duties and receiving LAFHA.

Individual living and working away from home can claim for expenses, food/drink, and accommodation. But there are certainly other expenses that can also be included as claimable expenses under the Living Away from Home Allowance.

Some expenses are listed below:

Now that you know which expenses you can claim as compensation for your living away from home allowance, you must also know that what records you need to maintain and why you should keep a record of all the expenses to give it to your employer or ATO.

Enlisted here are the records you should keep of all your expenses you can claim while living away from your home:

1. Entertainment – Food/Drink

Under LAFHA, you can claim all your meal expenses that include food and drinks. For this, you must provide evidence of the complete amount you are eligible for. There is no need to provide evidence if the food expenses equal or fall below the Commissioner’s reasonable food amount.

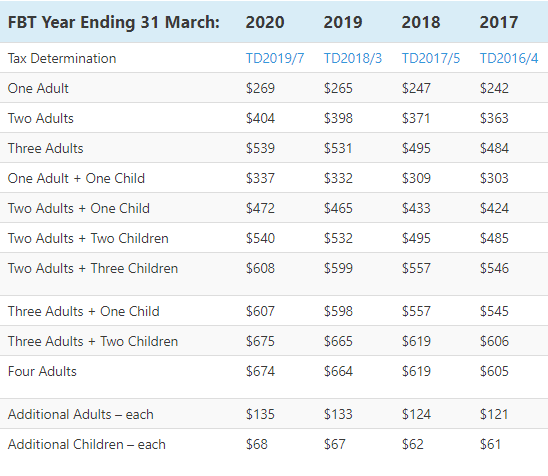

Reasonable Food and Drink Components (per week) within Australia*

2. Accommodation

If your normal residence is in Australia, or outside, to claim the accommodation expenditure, you need to incur the full amount with evidence. Accommodation includes:

For this, you can take guidance from the officers at the ATO or get the expert’s advice from professional tax accountants. You can also call us at 432 713 471.

You are liable to substantiate the full expense amount if your expenses exceed the calculated amount. If you are unclear or need expert guidance, you can consult the expert tax consultants or reach your nearest tax offices.

These allowances are taxed as a fringe benefit, which means the employee does not need to pay the tax; instead, the employer needs to. For this, the employment policies should clearly state that the allowance the employee should be receiving will not be a travel allowance; it must be a LAFHA.

For the Fringe Benefits Tax, the Living Away From Home Allowance is a calculated allowance that an employer needs to pay to its employees for compensation.

Three conditions must be satisfied for a payment to an employee to be considered as a LAFHA:

The taxable value of the living away from home allowance fringe benefit may vary due to the expenses such as food, drinks, and accommodation where:

If any of these conditions do not satisfy, the taxable value of the FBT equals the amount of the LAFHA paid to the employee.

LAFHA fringe benefit arises if the employer considers paying an allowance to their employees to compensate for the additional expenses while living away from their normal residence due to their employment demands and duties. This also covers any disadvantage the employees suffer due to their employment duties.

If you are one of those who live away from your normal residence and are eligible for the LAFHA fringe benefits, hope we got every information covered for you.